If you are not the stockholder of record, please refer to the voting instructions provided by your brokerage firm, bank or other nominee to direct it how to vote your shares.

All proxies will be voted in accordance with the instructions specified on the proxy card. If you sign a physical proxy card and return it without instructions as to how your shares should be voted on a particular proposal at the meeting,Annual Meeting, your shares will be voted in accordance with the recommendations of our Board of Directors stated above.

If you received a Notice of Internet Availability, please follow the instructions included on the notice on how to access your proxy card and vote through the Internet or by telephone. If you do not vote and you hold your shares in street name, and your broker does not have discretionary power to vote your shares, your shares may constitute “broker non-votes” (as described above) and will not be counted in determining the number of shares necessary for approval of the proposals. However, shares that constitute broker non-votes will be counted for the purpose of establishing a quorum for the meeting.

If you receive more than one proxy card or Notice of Internet Availability, your shares are registered in more than one name or are registered in different accounts. To make certain all of your shares are voted, please follow the instructions included on the Notice of Internet Availability on how to access each proxy card and vote each proxy card through the Internet. If you requested or received paper proxy materials by mail, please complete, sign and return each proxy card to ensure that all of your shares are voted.card.

The expenses of soliciting proxies will be paid by Trupanion. Following the original distribution and mailing of the solicitation materials, we or our agents may solicit proxies by mail, email, telephone, facsimile,or by other similar means, or in person.in-person. Our directors, officers and other employees, without additional compensation, may solicit proxies for us personally or in writing, by mail, email, telephone, email or otherwise.by other similar means. Following the original distribution and mailing of the solicitation materials, we will request brokers, custodians,brokerage firms, banks and other nominees and otherwho are record holders to forward copies of those materials to persons for whom they hold shares and to request authority for the exercise of proxies. In such cases, we, upon the request of the record holders, will reimburse such holders for their reasonable expenses. If you choose to access the proxy materials and/or vote through the Internet, by phone or by mail, you are responsible for any Internet access, telephone or data usage or postage charges you may incur.

Please note, however, that if your shares are held of record by a brokerage firm, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke or change any prior voting instructions.

The Notice of Internet Availability will provide you with instructions regarding how to:

Voting results will be tabulated and certified by the inspector of elections appointed for the meeting. The preliminary voting results will be announced at the meeting and posted on ourthe investor relations section of our website at https://investors.trupanion.com. The final results will be tallied by the inspector of elections and filed with the SEC in a current report on Form 8-K within four business days of the meeting.Annual Meeting.

We are strongly committed to good corporate governance practices. These practices provide an important framework within which our Board of Directors and management pursue our strategic objectives for the benefit of our stockholders.

Our Board of Directors has adopted Corporate Governance Guidelines that set forth expectations for directors, director independence standards, the board committee structure and functions and other policies for the governance of the company.our Company. Our Corporate Governance Guidelines are available without charge on the investor relations section of our website at www.trupanion.com.

Our Board of Directors believes that open communication between management and the Board of Directors is essential for effective risk management and oversight. OurIn addition to receiving daily Company performance reports, our Board of Directors meets with our Chief Executive Officer and other members of the senior management team at least quarterly at Board of DirectorDirectors meetings, where, among other topics, they discuss strategy and risks in the context of reports from the management team and evaluate the risks inherent in our business and significant transactions. While our Board of Directors is ultimately responsible for risk oversight, our Board committees assist the Board of Directors in fulfilling its oversight responsibilities in certain areas of risk. TheAmong other things, the audit committee assists our Board of Directors in fulfilling its oversight responsibilities with respect to risk management in the areas of internal control over financial reporting and disclosure controls and procedures. The compensation committee assists our Board of Directors in assessing risks created by the incentives inherent in ourwhether Trupanion’s executive compensation policies.programs and policies encourage undue or excessive risk-taking. The nominating and corporate governance Committeecommittee assists our Board of Directors in fulfilling its oversight responsibilities with respect to the management of risk associated with Board membership and corporate governance.

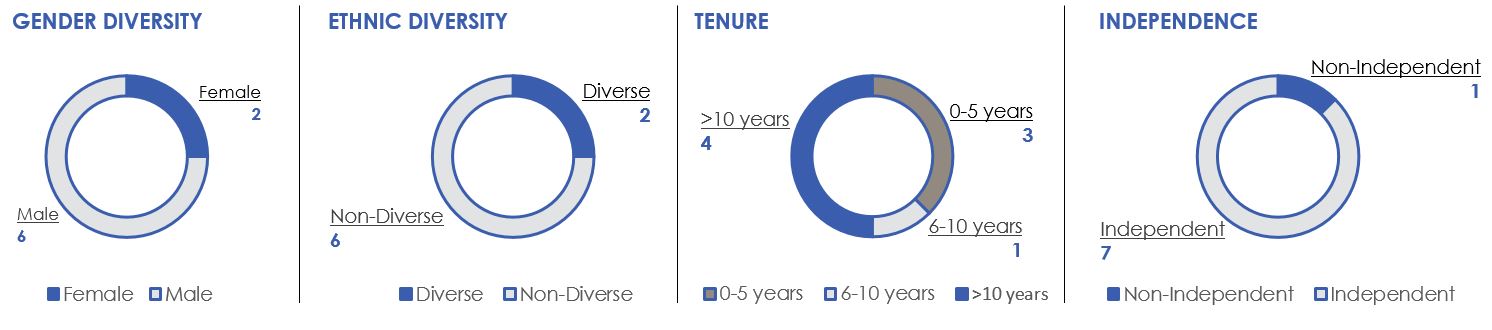

Our Board of Directors has undertaken a review of the independence of each director and considered whether each director has a material relationship with us that could compromisewould interfere with his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our Board of Directors determined that Ms. Davidson, Mr. Doak, Mr. Johnson, Mr. Levitan, Dr. Low, Messrs. Cohen, Doak, Levitan, LindsleyMr. Rubin and Novotny and Ms. Ferracone,Dr. Satchu, representing seven of our nineeight directors, are “independent directors” as defined under the applicable rules and regulations of the SEC and the listing requirements and rules of the NYSE.NASDAQ Stock Market. Our Board of Directors did not conclude that Mr. Rawlings was independent because he is our Chief Executive Officer. Mr. Rubin was an executive officer of ours eight years ago. He also formerly provided certain consulting services to us and our Board of Directors determined that these services no longer affect Mr. Rubin's independence. In making these determinations, our Board of Directors reviewed and discussed information provided by the directors and us with regard tothe Company regarding each director’s business and personal activities and relationships as they may relate to us and our management, including the beneficial ownership of our capital stock by each non-employee director and theother transactions involving them described in the section entitled “Transactions with Related Parties, Founders and Control Persons.”them.

Committees of Our Board of Directors

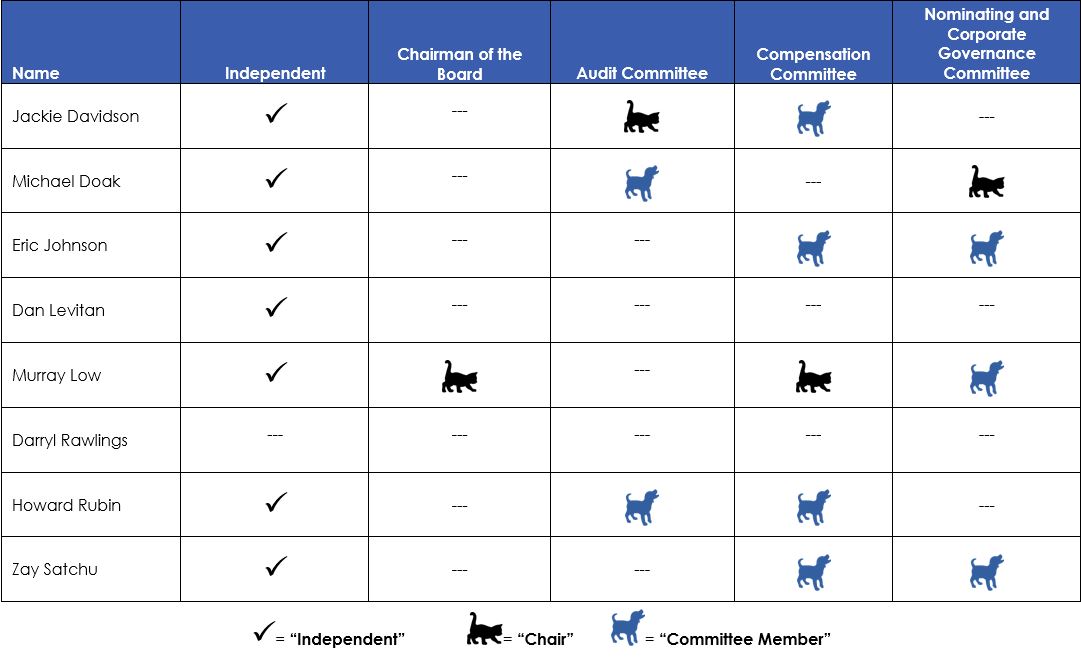

Our Board of Directors has established an audit committee, a compensation committee and a nominating and corporate governance committee.committee, each of which has a charter. The composition and responsibilities of each committee are described below. Members serve on these committees until their resignations or until otherwise determined by the Board of Directors. Copies of the charters for each committee are available without charge on the investor relations section of our website at www.trupanion.com.https://investors.trupanion.com/governance/Committee-Charters-Governance-Documents/default.aspx. As of April 26, 2022, the Company's committee composition is as follows:

Audit Committee. OurCommittee

In 2021, our audit committee iswas comprised of Messrs. Cohen,Ms. Davidson, Mr. Doak Lindsley and Novotny. Mr. Novotny isRubin, with Ms. Davidson serving as the chair of our audit committee. The composition of our audit committee meets the independence and other composition requirements for independence under the current NYSEapplicable NASDAQ Stock Market and SEC rules and regulations. Eacheach member of our audit committee is financially literate. In addition, our Board of Directors has determined that each member of our audit committee is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K promulgated under the Securities Act of 1933, as amended. This designation does not impose on him any duties, obligations or liabilities that are greater than are generally imposed on members of our audit committee and our Board of Directors.Act. Our audit committee’s principal functions are to assist our Board of Directors in its oversight of:

•our accounting and financial reporting processes, including our financial statement audits and the integrity of our financial statements;

•our compliance with legal and regulatory requirements;

•the qualifications, independence and performance of our independent auditors; and

•the preparation of the audit committee report to be included in our annual meeting proxy statement.statements.

Compensation Committee. OurCommittee

In 2021, our compensation committee iswas comprised of Messrs. LevitanMs. Davidson, Mr. Johnson, Dr. Low and Mr. Rubin. Former directors Robin Ferracone and Hays Lindsley also served on the compensation committee from January until June 2021, with Ms. Ferracone serving as compensation committee chair. Ms. Ferracone and Mr. Lindsley did not stand for re-election at the 2021 Annual Stockholder Meeting and Dr. Low. Ms. Ferracone is theLow was appointed as compensation committee chair of our compensation committee.in June 2021. The composition of our compensation committee meets the requirements for independence under the current NYSEapplicable NASDAQ Stock Market and SEC rules and regulations. Each member of this committee is also an outside director, within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended.rules. Our compensation committee’s principal functions are to assist our Board of Directors with respect to compensation matters, including:

•evaluating, recommending, approving and reviewing executive officer and director compensation arrangements, plans, policies and programs;

•administering our cash-based and equity-based compensation plans; and

•making recommendations to our Board of Directors regarding any other Board of Director responsibilities relating to executive compensation.compensation; and

•preparing the compensation committee report to be included in our annual meeting proxy statements.

Nominating and Corporate Governance Committee. OurCommittee

In 2021, our nominating and corporate governance committee iswas comprised of Messrs.Ms. Davidson, Mr. Doak, and Levitan, Ms. FerraconeMr. Johnson and Dr. Low. Dr. Low, iswith Mr. Doak serving as the chair of our nominating and corporate governance committee. In June 2021, Ms. Davidson stepped down from the nominating and corporate governance committee. Each nominating and corporate governance committee member is independent under the applicable NASDAQ Stock Market rules and SEC rules. Our nominating and corporate governance committee’s principal functions include, among other things:

include:

•identifying, considering and recommending candidates for membership on our Board of Directors;

•developing and recommending our corporate governance guidelines and policies;

•overseeing the process of evaluating the performance of our Board of Directors; and

•advising our Board of Directors on other corporate governance matters.

Corporate Governance and Ethics Principles

A primary goal of our Board of Directors is to build long-term value for our stockholders. Our Board of Directors has adopted and follows corporate governance practices that it and our senior management believe are sound and, promote this purpose, and represent best practices, including the establishment of the following:

•Code of Conduct and Ethics that sets forth our ethical principles and applies to all of our directors, officers and employees, including our Chief Executive Officer and Chief Financial Officer;

•Corporate Governance Guidelines that set forth our corporate governance principles;

•Insider Trading Policy and Pledging Guidelines for Directors and Officers that prohibit insider trading, limit pledging activities and prohibit engaging in any form of hedging transactions (derivatives, equity swaps, and so forth) in the Company's stock; and

•charters for our audit, compensation and nominating and corporate governance committees.committees that require independent oversight of key functions.

The full text of eachour Code of these policies,Conduct and Ethics, Corporate Guidelines, and committee charters and guidelines is posted on theour investor relations section of our website at investors.trupanion.com.https://investors.trupanion.com/governance/Committee-Charters--Governance-Documents/default.aspx. We intend to disclose any future amendments or waivers to provisionsour Code of Conduct and Ethics that applies to our code of business conduct and ethicsexecutive officers on our website or in public filings. We also have a number of internal policies, procedures, and systems, including policies relating to insider trading, andpledging, related-party transactions, clawback of incentive compensation and a confidential, anonymous system for employees and others to report concerns about fraud, accounting matters, violations of our policies and other matters.

Information contained on, or that can be accessed through, our website is not incorporated by reference, and you should not consider information on our website to be part of, this proxy statement.

Compensation Committee Interlocks and Insider Participation

The current members of our compensation committee are Messrs. Levitan and Lindsley,during the last concluded fiscal year were Ms. Ferracone and Mr. Lindsley, both of whom did not stand for re-election in 2021, along with current members Ms. Davidson, Mr. Johnson, Dr. Low. NoLow and Mr. Rubin. With the exception of Mr. Rubin, no member of the compensation committee washas served as an officer or employee of ours or any of our subsidiaries duringand no member of our compensation committee had any relationship with us requiring disclosure under Item 404 of Regulation S-K. Mr. Rubin currently serves as a director for American Pet Insurance Company, ZPIC Insurance Company, and QPIC Insurance Company, each a wholly-owned subsidiary of the fiscal year ended December 31, 2015. In addition, noneCompany. None of our executive officers currently serves or has served on the Board of Directors or compensation committee of any entity whose executive officers included any of our directors.

Board and Committee Meetings, Attendance, and AttendanceExecutive Sessions

The Board of Directors and its committees meet regularly throughout the year and also hold special meetings and act by written consent from time to time. During 2015, 2021:

•the Board of Directors held fivefour meetings including telephonic meetings, and acted by written consent six times;

•the audit committee held nine meetings, including telephonic meetings, five meetings;

•the compensation committee held thirteen meetings, including telephonicfour meetings and acted by written consent three times; and

•the nominating and corporate governance committee held sixfive meetings including telephonic meetings. and acted by written consent once.

During 2015, none of the directors2021, no director attended fewer than 75% of the aggregate of the total number of meetings held by the Board of Directors during his or her tenure and the total number of meetings held by all committees of the Board of Directors on which such director served, in each case during his or her tenure. The independent members of the time the director served on our Board of Directors also meet separately without management directors at least once per year to discuss such matters as the independent directors consider appropriate.

Directors.

Typically, in conjunction with the regularly scheduled meetings of the board,Board of Directors, the independent directors meet in executive sessions with our Chief Executive Officer outside the presence of management.other members of management and, separately, our non-employee directors meet outside the presence of the Chief Executive Officer. The Chairman of our Board of Directors, Dr. Low, presides over such executive sessions.

Board Attendance at Annual Stockholders’ Meeting

We invite and encourage each member of our Board of Directors to attend our annual meetings of stockholders. Westockholders though we do not have a formal policy regarding attendance of annual meetings by the members of our Board of Directors. We may consider in the future whether our companyCompany should adopt a more formal policy regarding director attendance at our annual meetings. All but oneEight of our nine then-current directors attended the 2015our 2021 Annual Meeting of Stockholders.

Role of Stockholder Engagement

Our Board of Directors believes it is important to regularly engage with our stockholders. In the past several years, we have proactively reached out to many of our largest stockholders to solicit their feedback on our executive compensation, corporate governance and disclosure practices in order to gain a better understanding of the practices they most value. Our stockholder engagement team has consisted of certain independent directors and members of our investor relations and legal team. Stockholders have also regularly met with members of our senior management team to discuss our strategy and review our operational performance.

Communication with Directors

Stockholders and interested parties who wish to communicate with our Board of Directors, non-managementnon-employee members of our Board of Directors as a group, a committee of the Board of Directors or a specific member of our Board of Directors (including our Chairman) may do so by letters addressed to the attention of our Corporate Secretary, Trupanion, Inc., 907 NW Ballard Way,6100 4th Avenue South, Suite 400, Seattle, WA 98107.

Washington 98108.

All communications are reviewed by theour Corporate Secretary and provided to the members of the Board of Directors unless such communications are unsolicited items, sales materials and/or other routine items, andor items unrelated to the duties and responsibilities of the Board of Directors.

Considerations in Evaluating Director Nominees

The nominating and corporate governance committee is responsible for identifying, evaluating and recommending candidatesnominees to the Board of Directors for Board membership.Directors. A variety of methods are used to identify and evaluate director nominees, with the goal of maintaining and further developing a diverse, experienced and highly qualified Board.Board of Directors. Candidates may come to our attention through current members of our Board of Directors, professional search firms, stockholders or other persons.

The nominating and corporate governance committee will recommend to the Board of Directors for selection all nominees to be proposed by the Board of Directors for election by the stockholders, including approval or recommendation of a slate of director nominees to be proposed by the Board of Directors for election at each annual meeting of stockholders, and will recommend all director nominees to be appointed by the Board of Directors to fill interim director vacancies.

Our Board of Directors encourages selection of directors who will contribute to theour Company’s overall corporate goals. The nominating and corporate governance committee may from time to time review and recommend to the Board of Directors the desired qualifications, expertise and characteristics of directors, including such factors as business experience, diversity and personal skillsprofessional experience in management, technology, finance, marketing, financial reporting and other areas that are expected to contribute to an effective Board of Directors. Exceptional candidates who do not meet all of these criteria may still be considered. In evaluating potential candidates for the Board of Directors, the nominating and corporate governance committee considers these factors in the light of the specific needs of the Board of Directors at that time.

In addition, under our Corporate Governance Guidelines, a director is expected to spend the time and effort necessary to properly discharge such director’s responsibilities. Accordingly, a director is expected to regularly attend meetings of the Board of Directors and committees on which such director sits and to review material distributed to the director. Thus, the number of other public company boards and other boards (or comparable governing bodies) on which a prospective nominee is a member, as well as his or her other professional responsibilities, will be considered. Also underUnder our Corporate Governance Guidelines, there are no limits on the number of three-year terms that may be served by a director. However, in connection with evaluating recommendations for nomination for reelection, the nominating and corporate governance committee considers director tenure. We value diversity on a company-wide basis but have not adopted a specific policy regarding Boardboard diversity.

Stockholder Recommendations for Nominations to the Board of Directors

The nominating and corporate governance committee will consider properly submitted stockholder recommendations for candidates for our Board of Directors who meet the minimum qualifications as described above. The nominating and corporate governance committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. A stockholder of record can nominate a candidate for election to the Board of Directors by complying with the procedures in Article I, Section 1.11 of our Bylaws. Any eligible stockholder who wishes to submit a nomination should review the requirements in the Bylaws on nominations by stockholders. Any nomination should be sent in writing to our Corporate Secretary, Trupanion, Inc., 907 NW Ballard Way,6100 4th Avenue South, Suite 400, Seattle, WA 98107.Washington 98108. Submissions must include the full name of the proposed nominee, complete biographical information, a description of the proposed nominee’s qualifications as a director, other information specified in our Bylaws, and a representation that the nominating stockholder is a beneficial or record holder of our stock and has been a holder for at least one year. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected. These candidates are evaluated at meetings of the nominating and corporate governance committee, and may be considered at any point during the year. If any materials are provided by a stockholder in connection with the recommendation of a director candidate, such materials are forwarded to the nominating and corporate governance committee.

All proposals of stockholders that are intended to be presented by such stockholder at an annual meeting of Stockholdersstockholders must be in writing and notice must be delivered to the Corporate Secretary at our principal executive offices not later than the close of business on the 75th day, nor earlier than the close of business on the 105th day, prior to the first anniversary of the preceding year’s annual meeting. Stockholders are also advised to review our Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations.

PROPOSAL NO. 1Proposal No. 2: Ratification of Independent Registered Public

ELECTION OF CLASS II DIRECTORSAccounting Firm

Our Board of Directors is divided into three classes. Each class serves for three years, with the terms of office of the respective classes expiring in successive years. Directors and director nominees in Class II will stand for election at this meeting. The terms of office of directors in Class III and Class I do not expire until the annual meetings of stockholders to be held in 2017 and 2018, respectively. Our nominating and corporate governance committee nominated Messrs. Cohen, Doak, and Rawlings, all incumbent Class II directors, for election as Class II directors at the 2016 annual meeting. At the recommendation of our nominating and corporate governance committee, our Board of Directors proposes that each of the three Class II nominees be elected as a Class II director for a three-year term expiring at the 2019 Annual Meeting of Stockholders and until such director’s successor is duly elected and qualified or until such director’s earlier resignation or removal.

Each director will be elected by a plurality of the votes present in person or represented by proxy at the meeting and entitled to vote on the election of directors. This means that the three individuals nominated for election to the Board of Directors at the meeting receiving the highest number of “FOR” votes will be elected. You may either vote “FOR” one, two or all nominees or “WITHHOLD” your vote with respect to one, two or all nominees. Shares represented by proxies will be voted “FOR” the election of each of the three Class II nominees, unless the proxy is marked to withhold authority to so vote. You may not cumulate votes in the election of directors. If any nominee for any reason is unable to serve the proxies may be voted for such substitute nominee as the proxy holders, who are officers of our company, might determine. Each nominee has consented to being named in this proxy statement and to serve if elected. Proxies may not be voted for more than three directors.

Nominees to the Board of Directors

The nominees, and their ages, occupations and length of board service are provided in the table below. Additional biographical descriptions of each nominee are set forth in the text below the table. These descriptions include the primary individual experience, qualifications, qualities and skills of each of our nominees that led to the conclusion that each director should serve as a member of our Board of Directors at this time.

|

| | | | | | |

Name of Director/Nominee | | Age | | Principal Occupation | | Director Since |

Chad Cohen (1)

| | 41 | | Chief Financial Officer, Adaptive Biotechnologies Corporation | | December 2015 |

Michael Doak (1) (2)

| | 40 | | President, RenaissanceRe Ventures U.S. LLC; and

Senior Vice President, RenaissanceRe Ventures Ltd.

| | February 2014 |

Darryl Rawlings | | 46 | | President and Chief Executive Officer, Trupanion, Inc. | | January 2000 |

| |

(1)

| Member of the audit committee |

| |

(2)

| Member of the nominating and corporate governance committee |

Chad Cohen has served as a member of our Board of Directors since December 2015. Since August 2015, Mr. Cohen has served as the Chief Financial Officer of Adaptive Biotechnologies Corporation, an immunosequencing company. Prior to that, Mr. Cohen served as the Chief Financial Officer of Zillow Group, Inc., an online real estate marketplace company, from March 2011 to August 2015.Mr. Cohen also served as Vice President of Finance at Zillow from September 2010 to March 2011 and as the Controller at Zillow from June 2006 to September 2010. Mr. Cohen previously worked for Ticketmaster Entertainment, Ernst & Young and Novellus Systems. Mr. Cohen has served on the Board of Directors of several private companies, including his current company. Mr. Cohen holds a B.S. from Boston University and is a Certified Public Accountant in the State of California (inactive). Mr. Cohen was chosen to serve on our Board of Directors based on his deep financial knowledge and significant public company CFO experience.

Michael Doak has served as a member of our Board of Directors since February 2014. Mr. Doak has served in various leadership roles at entities affiliated with RenaissanceRe Holdings Ltd., a global provider of reinsurance and insurance services, since June 2010, most recently as President of RenaissanceRe Ventures U.S. LLC and Senior Vice President of RenaissanceRe Ventures Ltd and formerly, as a Director of DaVinci Reinsurance Ltd. Prior to that, he served as an investment banker in the Financial Institutions Group at Morgan Stanley & Co. LLC, an investment bank, from September 2005 to May 2010. Mr. Doak holds a J.D. from the University of Pennsylvania Law School and a B.A. from the University of Virginia. Mr. Doak was chosen to serve on our Board of Directors based on his experience advising insurance and high-growth companies and his financial and investment expertise.

Darryl Rawlings is our founder and has served as our Chief Executive Officer and President and as a member of our Board of Directors since January 2000. Previously, Mr. Rawlings was a founder of the Canadian Cigar Company. Mr. Rawlings holds a Diploma of Marketing Management from the British Columbia Institute of Technology. Mr. Rawlings was chosen to serve on our Board of Directors based on his experience founding high-growth companies and his experience and familiarity with our business as its Chief Executive Officer since inception.

Continuing Directors

The directors who are serving for terms that end following the meeting, and their ages, occupations and length of board service are provided in the table below. Additional biographical descriptions of each such director are set forth in the text below the table. These descriptions include the primary individual experience, qualifications, qualities and skills of each of our nominees that led to the conclusion that each director should serve as a member of our Board of Directors at this time.

|

| | | | | | |

Name of Director | | Age | | Principal Occupation | | Director Since |

Class I Directors: | | | | | | |

Robin Ferracone (1) (2)

| | 62 | | Founder and Chief Executive Officer, Farient Advisors LLC | | December 2014 |

H. Hays Lindsley (1) (3)

| | 57 | | Member of Investment Team, Petrus Asset Management Company | | February 2013 |

Glenn Novotny (3)

| | 69 | | Founder and Owner, Glennhawk Vineyards and Emerald Pet Products | | February 2013 |

Class III Directors: | | | | | | |

Dan Levitan (1) (2)

| | 58 | | Managing Member, Maveron LLC | | April 2007 |

Murray Low (1) (2)

| | 63 | | Professor, Columbia Business School | | April 2006 |

Howard Rubin | | 63 | | Consultant, Trupanion, Inc. | | March 2010 |

| |

(1)

| Member of the compensation committee |

| |

(2)

| Member of the nominating and corporate governance committee |

| |

(3)

| Member of the audit committee |

Robin Ferracone has served as a member of our Board of Directors since December 2014. Since April 2007, Ms. Ferracone has served as the Chief Executive Officer of Farient Advisors, a performance advisory and strategic compensation firm. Previously, she was at Marsh & McLennan Companies, Inc., a global professional services firm in the areas of risk, strategy and human capital. Ms. Ferracone is also on the Board of Directors of a private company and is the trustee of several mutual funds. Ms. Ferracone holds an M.B.A. from Harvard Business School and a B.A. from Duke University. Ms. Ferracone was chosen to serve on our Board of Directors due to her extensive expertise in corporate governance and executive compensation strategy.

H. Hays Lindsley has served as a member of our Board of Directors since February 2013. Mr. Lindsley currently oversees private investments at Petrus Asset Management Company, an investment firm, where he has served in various roles relating to private investments since 1994. Mr. Lindsley has also served as Chairman and Chief Executive Officer of Higginbotham Bartlett of New Mexico, a lumber company, since September 2009. Previously, Mr. Lindsley served in various roles at Hillwood Development Company, LLC, a real estate development company, and was a tax lawyer at Jenkens & Gilchrist, LLP. Mr. Lindsley holds a J.D. and an M.B.A. from the University of Texas at Austin and a B.S. from Vanderbilt University. Mr. Lindsley was chosen to serve on our Board of Directors based on his extensive experience in business investments, finance and operations.

Glenn Novotny has served as a member of our Board of Directors since February 2013. Mr. Novotny is the founder and owner of Glennhawk Vineyards, a vineyard and winery, and Emerald Pet Products, an online wholesale distributer of treats for pets. Mr. Novotny also serves as the Managing Director of Glennmont, LLC and GMMR, LLC, both of which are real estate development organizations. Mr. Novotny was formerly the Operating Partner at Telegraph Hill Partners, a private equity firm investing in life science and healthcare companies, from 2008 to 2015. Prior to that, Mr. Novotny held key management positions, including, Chief Executive Officer and board member of Central Garden & Pet Company, a lawn and garden and pet supplies company, from 1990 to 2007. Mr. Novotny served in a number of operating, strategic planning, sales and executive management roles with Weyerhaeuser Company from 1970 to 1990. Mr. Novotny also serves on the Board of Directors of several private companies. Mr. Novotny completed the Executive Management Program at the Harvard Business School Program and holds a B.A. from Chadron State College. Mr. Novotny was chosen to serve on our Board of Directors based upon his significant experience in operations of high-growth companies, his knowledge of and experience in the pet industry, and his extensive experience serving on various boards of directors.

Dan Levitan has served as a member of our Board of Directors since April 2007. In 1998, Mr. Levitan co-founded Maveron LLC, a venture capital firm that invests in consumer companies. From 1983 to 1997, Mr. Levitan was employed by Wertheim Schroder & Co., an investment banking firm acquired by Salomon Smith Barney Inc. in 2000, most recently serving as a managing director. Mr. Levitan also currently serves on the boards of directors of Potbelly Corp., a national quick-service restaurant chain, and numerous private companies and non-profit organizations. In addition, Mr. Levitan is also on the advisory board of the Arthur Rock Center for Entrepreneurship at Harvard Business School and the board of trustees of Seattle Children’s Hospital Foundation. Mr. Levitan holds an M.B.A. from Harvard Business School and a B.A. from Duke University. Mr. Levitan was chosen to serve on our Board of Directors due to his extensive experience with a wide range of consumer companies and the venture capital industry and his operational and financial expertise.

Murray Low is currently the Chairman of our Board of Directors and has served as a member of our Board of Directors since April 2006. In addition, Dr. Low served as our Secretary and Treasurer from April 2006 to June 2006. Dr. Low has been a professor at Columbia Business School since 1990 and was the Founding Director of the Eugene M. Lang Center for Entrepreneurship at Columbia Business School from July 2000 to September 2013. Since July 2015, Dr. Low has been the Professor of Executive Education at Columbia Business School. From September 2013 to July 2015, Dr. Low was the Director of Entrepreneurship Education at Columbia Business School. Since 1997, Dr. Low has also served as President of Low & Associates. Dr. Low holds a Ph.D. from the University of Pennsylvania, and an M.B.A. and a B.A. from Simon Fraser University. Dr. Low was chosen to serve on our Board of Directors due to his expertise in the areas of entrepreneurship and strategic management and his deep knowledge of our business.

Howard Rubin has served as a member of our Board of Directors since March 2010. Mr. Rubin currently serves on the Dean’s Advisory Board for the College of Veterinary Medicine at Western University of Health Sciences, the Chief Executive Officer Advisory Committee of the Western Veterinary Conference and the American Veterinary Medical Association Insurance Trust Governance Task Force. Mr. Rubin previously served as our Chief Operating Officer from March 2010 to May 2014, and as our Secretary from July 2012 to August 2013. Mr. Rubin founded and served as Chief Executive Officer at BrightHeart Veterinary Centers, a company operating specialty and emergency veterinary hospitals, from November 2007 to October 2009 and as the Chief Executive Officer of the National Commission on Veterinary Economic Issues, a non-profit association supporting the animal health and veterinary industry, from January 2001 to October 2007. Previously, he served as the Chief Executive Officer of Cardiopet, Inc. and as a Divisional Vice President of IDEXX Laboratories, Inc. Mr. Rubin also founded the Veterinary Referral Centre, a comprehensive, multi-specialty veterinary hospital. Mr. Rubin holds an M.B.A. from Washington University in St. Louis’ Olin Business School and a B.A. from Ohio Wesleyan University. Mr. Rubin was chosen to serve on our Board of Directors based on his extensive experience in the veterinary care and animal health industries.

There are no familial relationships among our directors and officers.

Non-Employee Director Compensation

The following table presents the total compensation for each person who served as a non-employee member of our Board of Directors in the year ended December 31, 2015. Other than as set forth in the table, in the year ended December 31, 2015, we did not pay any fees to, make any equity awards or non-equity awards to, or pay any other compensation to the non-employee members of our Board of Directors, with the exception of reimbursement of expenses related to attendance at quarterly Board meetings. Mr. Rawlings, our Chief Executive Officer, received no compensation for his service as a director in the year ended December 31, 2015. The compensation provided to Mr. Rawlings is discussed in the section entitled “Executive Compensation.”

|

| | | | | | | | | | | | | | |

Name (1) | Option Awards ($)(2) | | | All Other Compensation ($) | | | Total |

Dr. Peter R. Beaumont (3) | $ | 50,000 |

| | | $ | 108,000 |

| | | $ | 158,000 |

| |

| Robin Ferracone | $ | 80,000 (4) |

| | | $ | — |

| | | $ | 80,000 |

| |

| Howard Rubin | $ | — |

| | | $ | 304,500 (5) |

| | | $ | 304,500 |

| |

| |

(1)

| Chad Cohen, Michael Doak, Dan Levitan, H. Hays Lindsley, Murray Low and Glenn Novotny also served as non-employee members of our Board of Directors in 2015. None of these directors were paid any compensation during 2015, nor did they hold any outstanding options to purchase shares of our common stock as of December 31, 2015, except for Dr. Low, who held options to purchase 8,750 shares of common stock at an exercise price of $4.05 per share, and Mr. Novotny, who held options to purchase 50,000 shares of common stock at an exercise price of $1.04 per share. |

| |

(2)

| The amounts reported in this column represent the aggregate grant date fair value of the stock options granted to our directors during the year ended December 31, 2015, as computed in accordance with Accounting Standards Codification Topic 718. The assumptions used in calculating the aggregate grant date fair value of the stock options reported in this column are set forth in Note 11 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2015. The amounts reported in this column reflect the accounting cost for these stock options, and do not correspond to the actual economic value that may be received by our directors from the stock options. |

| |

(3)

| Dr. Beaumont resigned as a director in December 2015. Amounts represent compensation paid to Dr. Beaumont for consulting services, which compensation consisted of $108,000 in cash and stock options to purchase 15,441 shares of common stock at an exercise price of $7.44 per share. As of December 31, 2015, Dr. Beaumont held outstanding options to purchase 56,303 shares of common stock at an exercise price of $1.04 per share and 15,441 shares of common stock at an exercise price of $7.44 per share. |

| |

(4)

| In February 2015, in connection with her December 2014 appointment to the Board of Directors, Ms. Ferracone was granted an option to purchase 23,360 shares of common stock at an exercise of $7.73 per share. All of such stock options remained outstanding as of December 31, 2015. |

| |

(5)

| Amount represents compensation paid to Mr. Rubin for certain services unrelated to his service as a director, including attending animal health industry events on our behalf. |

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ELECTION OF EACH OF THE THREE NOMINATED CLASS II DIRECTORS.

PROPOSAL NO. 2

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee has selected Ernst & Young LLP as our principal independent registered public accounting firm to perform the audit of our consolidated financial statements for the fiscal year ending December 31, 2016.2022. Ernst & Young LLP audited our financial statements for the fiscal yearsyear ended December 31, 20152021 and has been our independent registered public accounting firm since 2014. We expect that representatives of Ernst & Young LLP will be present atjoin the annual meeting,Annual Meeting in-person or via webcast, will be able to make a statement if they so desire, and will be available to respond to appropriate questions.

At the Annual Meeting, the stockholders are being asked to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016.2022. Our audit committee is submitting the selection of Ernst & Young LLP to our stockholders because we value our stockholders’ views on our independent registered public accounting firm and as a matter of good corporate governance. If this proposal does not receive the affirmative approval of a majority of the votes cast on the proposal, the audit committee would reconsider the appointment. Notwithstanding its selection and even if our stockholders ratify the selection, our audit committee, in its discretion, may appoint another independent registered public accounting firm at any time during the year if the audit committee believes that such a change would be in our best interests and the intereststhose of our stockholders.

| | |

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL NO. 2 |

The following table presents fees for professional audit services for the fiscal years ended December 31, 2015 and 2014, by Ernst & Young LLP.

Principal Accountant Fees and Services

The following table presents fees for professional services for the fiscal years ended December 31, 2021 and 2020, for Ernst & Young LLP. |

| | | | | | | | | |

| | | Fiscal Year 2015 | | | Fiscal Year 2014 |

Audit fees (1) | $ | 431,500 |

| | | $ | 1,373,000 |

| |

Audit related fees (2) | | — |

| | | | — |

| |

Tax fees (3) | | 25,500 |

| | | | — |

| |

All other fees (4) | | 1,995 |

| | | | 2,000 |

| |

| Total fees | $ | 458,995 |

| | | $ | 1,375,000 |

| |

| | | | | | | | |

| Fiscal Year 2021 | Fiscal Year 2020 |

| Audit fees (1) | $ | 905,000 | | $ | 872,000 | |

| All other fees (2) | $ | 2,710 | | $ | 13,535 | |

| Total fees | $ | 907,710 | | $ | 885,535 | |

| |

(1)(1)Audit fees consist of fees for professional services provided in connection with the audit of our annual consolidated financial statements and our internal control over financial reporting, the review of our quarterly consolidated financial statements, incremental audit fees, and audit services that are normally provided by independent registered public accounting firms in connection with statutory and regulatory filings or engagements for those fiscal years, such as statutory audits.

| Audit fees consist of fees for professional services provided in connection with the audit of our annual consolidated financial statements, the review of our quarterly consolidated financial statements, and audit services that are normally provided by independent registered public accounting firm in connection with statutory and regulatory filings or engagements for those fiscal years, such as statutory audits. The audit fees also include fees for professional services provided in connection with our initial public offering, incurred during the fiscal year ended December 31, 2014, including comfort letters, consents and review of documents filed with the SEC. |

| |

(2)

| Audit-related feesinclude fees billed for assurance and related services reasonably related to the performance of the audit.

|

| |

(3)

| Tax feesinclude fees for tax compliance and advice.

|

| |

(4)

| All other fees consist of fees for access to online accounting and tax research software. |

(2)All other fees consist of fees for access to online accounting and tax research software, accounting consultation fees, and examination fees for the Department of Insurance for one of the Company's subsidiaries.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our audit committee generally pre-approves all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The independent registered public accounting firm and management are required to periodically report to the audit committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. Our audit committee may also pre-approve particular services on a case-by-case basis. All of the services relating to the fees described in the table above were pre-approved by our audit committee.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL NO. 2

PROPOSAL NO. 3

APPROVAL OF AMENDMENT TO OUR RESTATED CERTIFICATE OF INCORPORATION TO DECREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 200,000,000 TO 100,000,000

The Board of Directors has unanimously approved, subject to stockholder approval, a proposal to amend our Restated Certificate of Incorporation to reduce the number of our authorized shares of common stock from 200,000,000 to 100,000,000. No other changes will be made to the other provisions of our Restated Certificate of Incorporation.

Current Structure

As of April 1, 2016, we had 200,000,000 authorized shares of common stock, of which 28,577,926 shares were issued and outstanding, and 10,000,000 authorized shares of preferred stock, of which no shares were issued and outstanding. Of the remaining 171,422,074 authorized shares of common stock, 620,979 shares are held as treasury shares, 8,926,325 shares are either subject to outstanding awards or reserved for future issuance under our 2014 Equity Incentive Plan, 869,999 shares are subject to outstanding warrants to purchase shares of common stock and 2,574,690 shares are reserved for issuance under our 2014 Employee Stock Purchase Plan, resulting in an aggregate of 159,051,060 shares of our authorized common stock remaining available for future issuance.

PurposeReport of the Amendment and Restatement

Our Board’s primary reason for approving an amendment to our Restated Certificate of Incorporation and reduce our authorized capital stock is to reduce the amount of our annual franchise tax in the State of Delaware, while still maintaining a sufficient number of authorized shares to permit us to act promptly with respect to future financings, acquisitions, additional issuances and for other corporate purposes. Each year, we are required to make franchise tax payments to the State of Delaware in an amount determined, in part, by the total number of shares of stock we are authorized to issue. Therefore, the amount of this tax will be decreased if we reduce the number of authorized shares of our common stock (unless before and after such reduction, we are subject to the maximum tax amount). While the exact amount of such cost savings will depend on a number of factors, and could change year to year, we estimate the amount of tax savings to be approximately $85,000 in 2017 based on the current Delaware law.

Effects of the Amendment and Restatement

If the proposed amendment to our Restated Certificate of Incorporation is approved, the number of our authorized shares of common stock will be reduced from 200,000,000 to 100,000,000. The number of our authorized shares of preferred stock will remain unchanged, with an authorized amount of 10,000,000 shares of preferred stock. The amendment will not change the par value of the shares of our common stock, affect the number of shares of our common stock that are outstanding, or affect the legal rights or privileges of holders of existing shares of common stock. The reduction will not have any effect on any outstanding equity incentive awards to purchase our common stock.

The proposed decrease in the number of authorized shares of common stock could have adverse effects on us. Our Board will have less flexibility to issue shares of common stock without stockholder approval, including in connection with a potential merger or acquisition, stock dividend or follow on offering. In the event that our Board determines that it would be in our best interest to issue a number of shares of common stock or preferred stock in excess of the number of then-authorized but unissued and unreserved shares, we would be required to seek the approval of our stockholders to increase the number of shares of authorized common stock, as applicable, which may increase our expenses. If we are not able to obtain the approval of our stockholders for such an increase in a timely fashion, we may be unable to take advantage of opportunities that might otherwise be advantageous to us and our stockholders. However, our Board has determined that these potential risks are outweighed by the anticipated benefits of reducing our Delaware franchise tax obligations.

Audit Committee

This description of the effects of the proposed amendment to our Restated Certificate of Incorporation is a summary and is qualified by the full text of the proposed Certificate of Amendment to our Restated Certificate of Incorporation, which is attached to this Proxy Statement as

Appendix A, with additions indicated by underlined text and deletions indicated by strikethrough text.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL NO. 3

REPORT OF THE AUDIT COMMITTEE

The information contained in the following report of the audit committee is not considered to be “soliciting material,”material”, “filed” or incorporated by reference in any past or future filing by us under the Securities Exchange Act of 1934 or the Securities Act of 1933 unless and only to the extent that we specifically incorporate it by reference.

The audit committee of the Board of Directors of Trupanion, Inc. has reviewed and discussed with ourthe Company's management and Ernst & Young LLP ourthe Company's audited consolidated financial statements as of and for the year ended December 31, 2015.2021. The audit committee has also discussed with Ernst & Young LLP the matters required to be discussed by Public Company Accounting Oversight Board (PCAOB) Auditing Standard No. 16, 1301, Communications with Audit Committees.

Committees and the Securities and Exchange Commission.

The audit committee has received and reviewed the written disclosures and the letter from Ernst & Young LLP required by PCAOB Rule No. 3526 regarding the independent accountant’s independence, and has discussed with Ernst & Young LLP its independence.

Based on the review and discussions referred to above, the audit committee recommended to our Board of Directors that the audited consolidated financial statements as of and for the year ended December 31, 2015 be included in our annual report on Form 10-K for the year ended December 31, 20152021 for filing with the Securities and Exchange Commission.

Submitted by the Audit Committee

Glenn Novotny, Chair

Chad Cohen

Michael Doak

H. Hays Lindsley

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of April 1, 2016, by:

each stockholder known by us to be the beneficial owner of more than 5% of our common stock;

each of our directors or director nominees;

each of our named executive officers; and

all of our directors and executive officers as a group.

Percentage ownership of our common stock is based on 28,577,926 shares of our common stock outstanding on April 1, 2016. We have determined beneficial ownership in accordance with the rules of the SEC, and thus it represents sole or shared voting or investment power with respect to our securities. Unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all shares that they beneficially owned, subject to community property laws where applicable. We have deemed all shares of common stock subject to options, restricted stock units (RSUs) or other convertible securities held by that person or entity that are currently exercisable or releasable or that will become exercisable or releasable within 60 days of April 1, 2016 to be outstanding and to be beneficially owned by the person or entity holding the option for the purpose of computing the percentage ownership of that person or entity but have not treated them as outstanding for the purpose of computing the percentage ownership of any other person or entity.

Unless otherwise indicated, the address of each of the individuals and entities named below is c/o Trupanion, Inc., 907 NW Ballard Way, Seattle, Washington 98107.

|

| | | | | |

| Name of Beneficial Owner | | Number of Shares

Beneficially Owned | | Percentage |

| | | | | |

| 5% or greater stockholders: | | | | |

Entities affiliated with Maveron (1) | | 6,553,586 |

| | 22.9% |

Entities affiliated with Highland Consumer Fund (2) | | 3,096,427 |

| | 10.8% |

RenaissanceRe Ventures Ltd. (3) | | 2,755,000 |

| | 9.6% |

Capital World Investors (4) | | 2,257,500 |

| | 7.9% |

Wasatch Advisors, Inc. (5) | | 1,941,984 |

| | 6.8% |

| Directors and Named Executive Officers: | | | | |

Darryl Rawlings (6) | | 2,448,366 |

| | 8.3% |

Michael Banks (7) | | 274,923 |

| | * |

Timothy Graff (8) | | 76,801 |

| | * |

Chad Cohen (9) | | 5,120 |

| | * |

Michael Doak (10) | | 5,120 |

| | * |

Robin Ferracone (11) | | 57,269 |

| | * |

Dan Levitan (1) (12) | | 6,558,706 |

| | 23.0% |

H. Hays Lindsley (13) | | 71,790 |

| | * |

Murray Low (14) | | 260,683 |

| | * |

Glenn Novotny (15) | | 128,976 |

| | * |

Howard Rubin (16) | | 790,639 |

| | 2.7% |

| | | | | |

All officers and directors as a group (13 persons) (17) | | 10,790,758 |

| | 37.4% |

* Represents beneficial ownership of less than 1% of our outstanding shares of common stock.

| | |

(1)

| Based solely on the Schedule 13G filed by Maveron Equity Partners III, L.P. (Maveron Equity) on February 12, 2016. Consists of (i) 5,556,046 shares held by Maveron Equity, (ii) 235,731 shares held by Maveron III Entrepreneurs’ Fund, L.P. (Maveron Entrepreneurs) and (iii) 761,809 shares held by MEP Associates III, L.P. (together with Maveron Equity and Maveron Entrepreneurs, the Maveron Entities). Maveron General Partner III LLC (Maveron LLC) is the general partner of each of the Maveron Entities. Dan Levitan, a member of our Board of Directors, Clayton Lewis, Peter McCormick and Jason Stoffer are the managing members of Maveron LLC and, as such, share voting and dispositive power over the shares heldSubmitted by the Maveron Entities. The principal business address of each of the Maveron Entities is 411 First Avenue South, Suite 600, Seattle, Washington 98104. |

| Audit Committee |

(2)

| Based on the Schedule 13G filed by Highland Consumer GP GP LLC (HC LLC) on February 16, 2016. Consists of (i) 2,438,064 shares and 48,176 shares underlying warrants to purchase common stock that are exercisable within 60 days of April 1, 2016 are held by Highland Consumer Fund I Limited Partnership (Highland Consumer I), (ii) 520,175 shares and 10,278 shares underlying warrants to purchase common stock that are exercisable within 60 days of April 1, 2016 are held by Highland Consumer Fund 1-B Limited Partnership (Highland Consumer 1B) and (iii) 78,189 shares and 1,545 shares underlying warrants to purchase common stock that are exercisable within 60 days of April 1, 2016 are held by Highland Consumer Entrepreneurs’ Fund I, Limited Partnership (together with Highland Consumer I and Highland Consumer 1B, the Highland Entities). Highland Consumer GP Limited Partnership (HC LP) is the general partner of each of the Highland Entities. HC LLC is the general partner of HC LP.Peter Cornetta, Daniel Nova and Thomas Stemberg are the managers of HC LLC. Each of HC LP and HC LLC, as the general partner of the general partner of the Highland Entities, respectively, is deemed to have beneficial ownership of the shares held by the Highland Entities. Voting and investment decisions of HC LLC are made by the managers of HC LLC. The principal business address for the Highland Consumer Entities is One Broadway, 16th Floor, Cambridge, Massachusetts 02142.

|

| Jacqueline Davidson, Chair |

(3)

| Based solely on the Schedule 13G filed by RenaissanceRe Ventures Ltd. (Ventures) on February 5, 2016. Consists of 2,755,000 shares. Ventures is a wholly owned subsidiary of Renaissance Other Investments Holdings II Ltd. (Holdings), which in turn is a wholly owned subsidiary of RenaissanceRe Holdings Ltd. (RenaissanceRe). By virtue of these relationships, RenaissanceRe and Holdings may be deemed to have voting and dispositive power over the shares held by Ventures. The principal business address of RenaissanceRe is Renaissance House, 12 Crow Lane, Pembroke HM19, Bermuda. |

| Michael Doak |

(4)

| Based solely on the Schedule 13G filed by Capital World Investors on February 16, 2016. Consists of 2,257,500 shares over which Capital World Investors has sole voting and dispositive power. Capital World Investors is a division of Capital Research and Management Company. The principal business address of Capital World Investors is 333 South Hope Street, Los Angeles, California 90071.Howard Rubin |

| |

(5)

| Based solely on the Schedule 13G filed by Wasatch Advisors, Inc. on February 16, 2016. Consists of 1,941,984 shares over which Wasatch Advisors, Inc. has sole voting and dispositive power. The principal business address of Wasatch Advisors, Inc. is 505 Wakara Way, Salt Lake City, Utah 84108. |

| |

(6)

| Consists of (i) 1,594,095 shares held by Mr. Rawlings, of which 467,508 are shares of unvested restricted stock subject to our right of repurchase and (ii) 854,271 shares underlying options to purchase common stock that are exercisable within 60 days of April 1, 2016. Mr. Rawlings holdings exclude 120,481 shares held by Rawlings GST Trust dated March 1, 2012, of which Murray Low, a member of our Board of Directors, is the trustee and the Rawlings GST Exempt Trust FBO and Rawlings GST Non-Exempt Trust FBO are the beneficiaries, of which Mr. Rawlings’ children are beneficiaries. |

| |

(7)

| Consists of (i) 6,175 shares held by Mr. Banks and (ii) 268,748 shares underlying options to purchase common stock that are exercisable within 60 days of April 1, 2016. |

| |

(8)

| Consists of (i) 33,053 shares held by Mr. Graff and (ii) 43,748 shares underlying options to purchase common stock that are exercisable within 60 days of April 1, 2016. |

| |

(9)

| Consists of 5,120 shares underlying options to purchase common stock that are exercisable within 60 days of April 1, 2016 held by Mr. Cohen. |

| |

(10)

| Consists of 5,120 shares underlying options to purchase common stock that are exercisable within 60 days of April 1, 2016 held by Mr. Doak. |

| |

(11)

| Consists of (i) 28,106 shares held by Robin A. Ferracone TTEE of the Robin A. Ferracone Living Trust dtd 6/3/2002 and (ii) 29,163 shares underlying options to purchase common stock that are exercisable within 60 days of April 1, 2016 held by Ms. Ferracone. |

| |

(12)

| Consists of 5,120 shares underlying options to purchase common stock that are exercisable within 60 days of April 1, 2016 held by Mr. Levitan. |

| |

(13)

| Consists of (i) 66,670 shares held by Lindsley Partners, L.P. (Lindsley Partners) and (ii) 5,120 shares underlying options to purchase common stock that are exercisable within 60 days of April 1, 2016 held by Mr. Lindsley. The HHL09 Trust is the sole member of Zoida LLC, which is the general partner of Lindsley Partners. H. Hays Lindsley, a member of our Board of Directors, is the sole trustee of the HHL09 Trust and, as such, holds sole voting and investment power over the shares. |

| |

(14)

| Consists of (i) 178,630 shares and 14,553 shares underlying options to purchase common stock that are exercisable within 60 days of April 1, 2016 held by Mr. Low and (ii) 67,500 shares held by Murray R. Low ROTH IRA #90GK49015. |

| |

(15)

| Consists of (i) 5,000 shares and 56,144 shares underlying options to purchase common stock that are exercisable within 60 days of April 1, 2016 held by Mr. Novotny, (ii) 3,004 shares held by Glenn and Linda Novotny 1996 Living Trust, of which Mr. and Mrs. Novotny are beneficiaries and (iii) 64,828 shares held by Linda K. Novotny Irrevocable Trust dated December 27, 2012, of which Scott Kerr is trustee and Christina Kerr, Teresa Novotny-Micheal, Angela Ovalle and Glenn Novotny are beneficiaries. |

| |

(16)

| Consists of 790,639 shares underlying options to purchase common stock that are exercisable within 60 days of April 1, 2016 held by Mr. Rubin. |

| |

(17)

| Consists of (i) 8,601,347 shares held by our directors and executive officers as a group and (ii) 2,189,411 shares underlying options to purchase common stock that are exercisable within 60 days of April 1, 2016 held by our directors and executive officers as a group. |

Executive Officers

Our executive officers and their respective ages and positions as of April 21, 2016,11, 2022 are as follows:

|

| | | | | | | |

NAME Name | Age | AGE | | POSITION |

Executive OfficersTitle (1) |

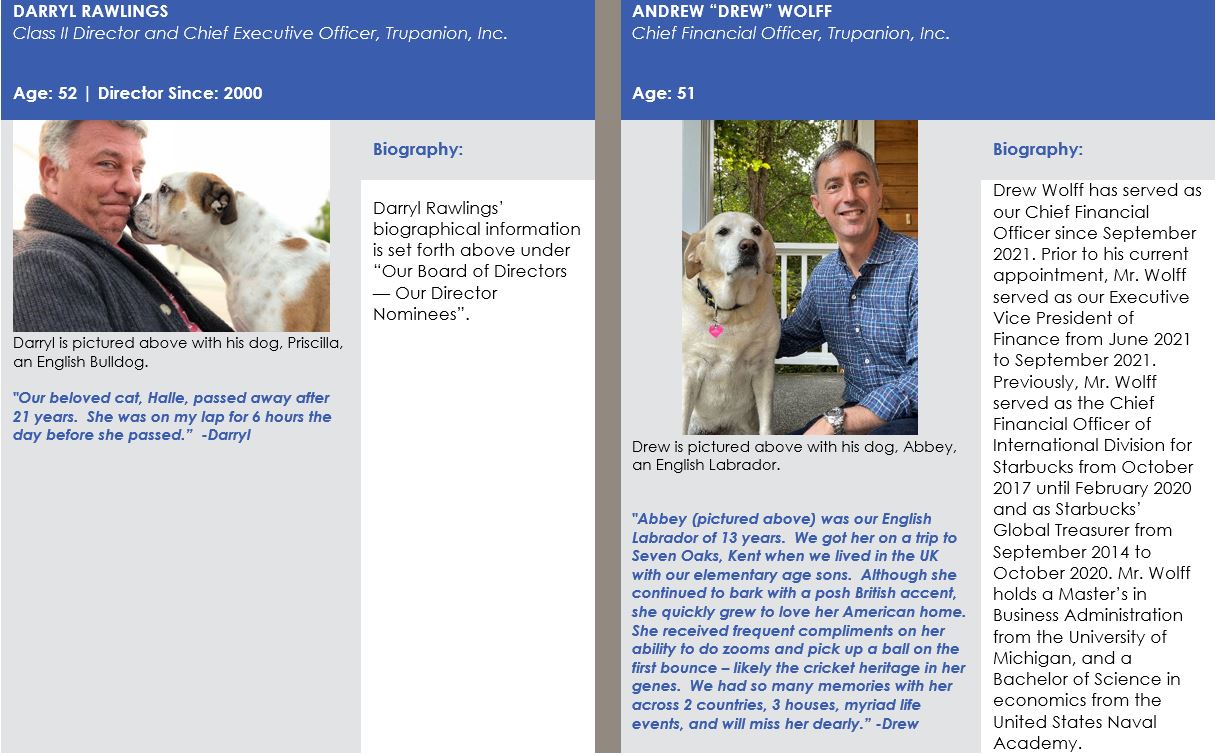

| Darryl Rawlings | | 47 | 52 | Chief Executive Officer President and Director |

Michael BanksAndrew "Drew" Wolff | | 56 | 51 | Chief Financial Officer (2) |

Tim GraffMargaret "Margi" Tooth | | 54 | 43 | President of American Pet Insurance Company(3) |

Ian MoffatTricia Plouf | | 40 | 43 | Chief Operating Officer (4) |

Margaret ToothGavin Friedman | 54 | 37 | | Chief Marketing OfficerExecutive Vice President, Legal, and Corporate Secretary (5) |

Darryl Rawlings(1) is our founder and has servedReflects current titles as our Chief Executive Officer and President and as a member of our Board of Directors since January 2000. Previously, Mr. Rawlings was a founder of the Canadian Cigar Company. date of this Proxy Statement.

(2)Mr. Rawlings holds a Diploma of Marketing Management from the British Columbia Institute of Technology. Mr. RawlingsWolff became an employee on May 24, 2021 and was chosenappointed to serve on our Board of Directors based on his experience founding high-growth companies and his experience and familiarity with our business as its Chief Executive Officer since inception.

Michael Banks has served as ourTrupanion's Chief Financial Officer since June 2012. Previously,on September 24, 2021.

(3)On February 10, 2022, Ms. Tooth's title changed from Co-President to President.

(4)Ms. Plouf served as both Co-President and Chief Financial Officer until September 24, 2021 when Mr. BanksWolff became Chief Financial Officer. On February 10, 2022, Ms. Plouf's title changed to Chief Operating Officer.

(5)Mr. Friedman served as the Company's Chief FinancialPeople Officer at Penn Millers Holding Corporation, a provider of property casualty insurance, from August 2002and recently transitioned his responsibilities to May 2012. Prior to that, Mr. Banks served as the Vice President, Treasurerfocus exclusively on legal and Comptroller at Atlantic Mutual Insurance Company, Inc. and as the Vice President and Assistant Controller at AMBAC Indemnity Corporation. Mr. Banks holds a B.S. from the University of Delaware.regulatory matters.

Tim Graff has served as the President of American Pet Insurance Company (APIC), our insurance company subsidiary, since October 2012. Previously, Mr. Graff served as Senior Vice President at QBE North America, a division of the QBE Insurance Group Ltd., an insurance company, from March 2011 to May 2012. Prior to that, Mr. Graff served in various leadership roles, including most recently as Senior Vice President, at U.S. subsidiaries of RenaissanceRe Holdings Ltd., a global catastrophe reinsurer, from December 2003 to March 2011.

Ian Moffat has served as our Chief Operating Officer since November 2015. Prior his current appointment, Mr. Moffat served as our Senior Vice President and Vice President of Operations, from October 2012 to November 2015. Previously, Mr. Moffat served as the Head of Operations and in various other roles at Allianz Insurance plc, from June 1997 to August 2012.

Margaret Tooth has served as our Chief Marketing Officer since November 2015. Prior to her current appointment, Ms. Tooth served as Head of Marketing, from June 2014 to November 2015, and as our Vice President of Digital Marketing, from October 2013 to June 2014. Previously, Ms. Tooth held various positions at Allianz Insurance plc, including Acting Head of Marketing, in 2011, and as the E-commerce and Brand Manager, from 2009 to 2013. Prior to that, Ms. Tooth has also held senior marketing roles within business to business and direct to consumer brand functions in the United Kingdom.

Our executive officers are appointed by, and serve at the discretion of, our Board of Directors. There are no family relationships among any of our directors or executive officers. All executive officers are, together with Asher Bearman, "named executive officers" for the fiscal year ended December 31, 2021.

EXECUTIVE COMPENSATION

Proposal No. 3: Advisory and Non-Binding Vote to Approve the Compensation Provided to the Company’s Named Executive Officers for 2021

Say-On-Pay

We are asking our stockholders to vote, on an advisory, non-binding basis, to approve a resolution on the compensation of the Company’s named executive officers, as reported in this proxy statement pursuant to Item 402 of Regulation S-K (commonly referred to as a "say-on-pay" vote). As described in the “Compensation Discussion and Analysis” section of this proxy statement, our compensation philosophy drives our compensation programs, which are designed to align the interests of our executive officers with those of our stockholders, our corporate objectives, our desired behaviors and Company culture, as well as to attract, motivate, and retain key employees who are critical to the success of our Company. Under these programs, our executive officers, including our named executive officers, are motivated to achieve specific strategic objectives that are expected to increase stockholder value. Please read the “Compensation Discussion and Analysis” section of this proxy statement and the “Executive Compensation Tables” and narrative discussion for additional details about our compensation programs, including information about the 2021 compensation for our named executive officers.

| | |

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL NO. 3 |

Say-On-Pay Resolution

At the Annual Meeting, stockholders are being asked to approve the compensation of our named executive officers as described in this proxy statement by voting in favor of the resolution set forth below. This vote is not needed to address any specific item of compensation, but rather the overall compensation of our named executive officers and the policies and practices described in this proxy statement.

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to the SEC's executive compensation disclosure rules, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED."

Even though this say-on-pay vote is advisory, and therefore will not be binding on us, we value the opinions of our stockholders. Accordingly, to the extent there is a significant vote against the compensation for our named executive officers, we will consider our stockholders’ concerns and the compensation committee will evaluate what actions may be necessary or appropriate to address those concerns. Stockholders who vote against the resolution are encouraged to contact the Board of Directors to explain their concerns in writing to:

Trupanion, Inc.

6100 4th Avenue South, Suite 400

Seattle, Washington 98108

Attn: Corporate Secretary

Unless the Board of Directors modifies its policy regarding the frequency of future say-on-pay advisory votes, the next say-on-pay advisory vote will be held at the 2023 Annual Meeting of Stockholders.

Executive Compensation

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (CD&A) explains our executive compensation philosophy and programs, the decisions our compensation committee made under those programs, and their rationale in making those decisions. While this CD&A focuses on the compensation of our named executive officers, it also discusses our compensation philosophy and programs more broadly in the organization. This broader discussion provides a lens into our values and culture and how we believe they are in the long-term best interests of our stockholders.

Part 1. Organization of this CD&A

1.1 CD&A Sections

We have organized this CD&A into the following six sections:

| | | | | |

| Key Sections | Core Topics |

| Part 1. Organization of this CD&A | 1.1 CD&A Sections |

| Part 2. Executive Summary | 2.1 Named Executive Officers 2.2 Business Overview and Performance 2.3 Compensation Highlights - Compensation Philosophy - Consideration of "Say-on-Pay" Vote - Compensation Programs - Compensation Mix - Alignment with Stockholders |

| Part 3. Our Culture | 3.1 Who We Are |

| Part 4. Governance of Executive Compensation | 4.1 Role of the Compensation Committee

4.2 Role of Management

4.3 Role of Consultant

4.4 Peer Group

|

| Part 5. Components of Executive Compensation | 5.1 Key Elements of Compensation 5.2 Detailed Description of Each Element of Compensation and Determination of Compensation for 2021 Performance Year ‐ Base Salary ‐ Short-Term Incentive Awards ‐ Long-Term Incentive Awards ◦ Equity Allocations in 2022 for the 2021 Performance Year ◦ 2020 Long-Term Incentive Awards Reflected in 2021 Summary Compensation Table ‐ Other Equity Awards for 2021 Company Performance Issued in 2022 - Other Compensation and General Benefits

|

| Part 6. Other Compensation Policies and Practices | 6.1 Employment Agreements

6.2 Severance and Change-in-Control Protection

6.3 Share Ownership

6.4 Risk Assessment

6.5 Clawbacks

6.6 Pledging & Hedging

6.7 Discussion on Key Performance Metrics |

Part 2. Executive Summary

2.1 Named Executive Officers

For 2021, our named executive officers were:

| | | | | |

| Name | Title (1) |

| Darryl Rawlings | Chief Executive Officer and Director |

| Drew Wolff | Chief Financial Officer (2) |

| Margi Tooth | President (3) |

| Tricia Plouf | Chief Operating Officer (4) |

| Gavin Friedman | Executive Vice President, Legal, and Corporate Secretary (5) |

| Asher Bearman | Executive Vice President, Corporate Development |

(1)Reflects current titles as of the date of this Proxy Statement.

(2)Mr. Wolff became an employee on May 24, 2021 and was appointed to serve as Trupanion's Chief Financial Officer on September 24, 2021.

(3)On February 10, 2022, Ms. Tooth's title changed from Co-President to President.

(4)Ms. Plouf served as both Co-President and Chief Financial Officer until September 24, 2021 when Mr. Wolff became Chief Financial Officer. On February 10, 2022, Ms. Plouf's title changed to Chief Operating Officer.

(5)Mr. Friedman also served as the Company's Chief People Officer and recently transitioned his responsibilities to refocus exclusively on legal and regulatory matters.

2.2 Business Overview and Performance

Trupanion's mission is to help loving, responsible pet owners budget and care for their pets. We offer medical insurance for cats and dogs to help pet owners solve the problem of budgeting for unexpected veterinary expenses should their pet become sick or injured. As of December 31, 2021, we insured over 1,176,000 pets in North America.

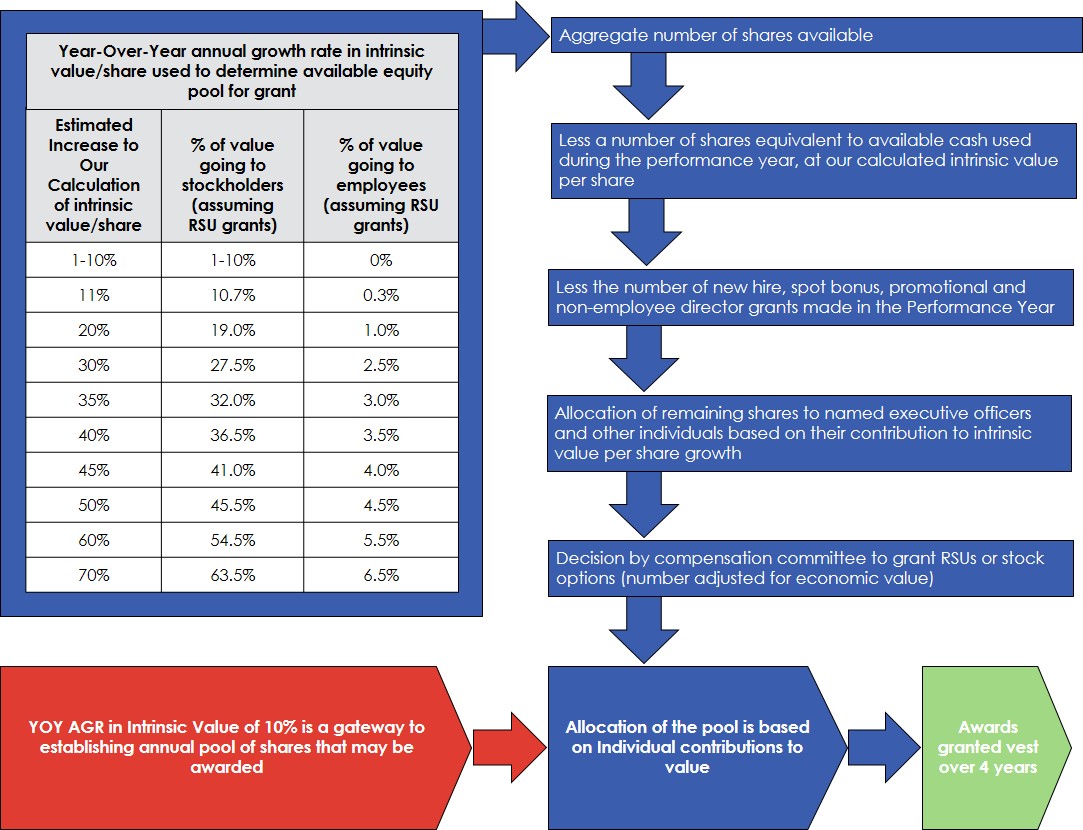

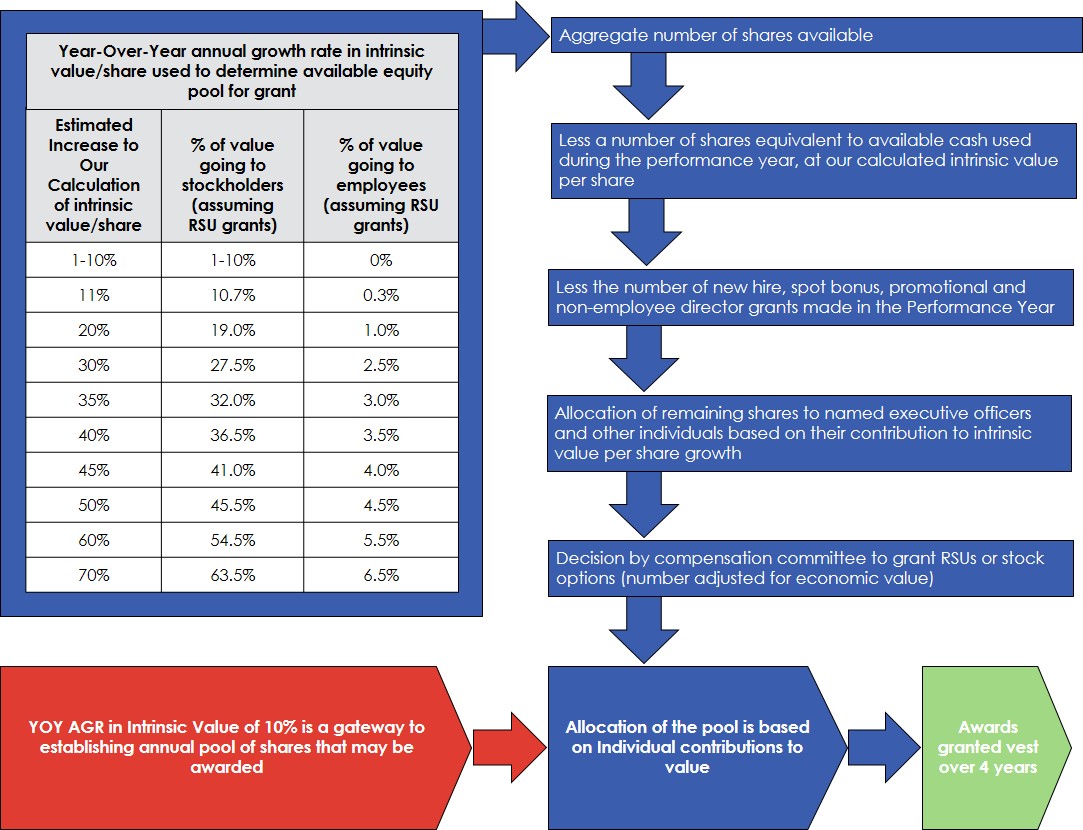

Our revenue for the calendar year 2021 was $699 million, an increase of 39% year-over-year, primarily comprised of subscription fees for our Trupanion-branded medical insurance and policies written on behalf of third parties. Growth of our intrinsic value is the primary internal measure we use to evaluate corporate and named executive officer long-term performance. For performance year 2020, we calculated the growth of intrinsic value based on a two-year compound annual growth rate and for performance year 2021, we returned to using a year-over-year annual growth calculation. We believe this approach better reflects performance of the Company and the team in a given year while also reducing complexity. In 2021, for the evaluation of team compensation, we calculated an estimated increase in intrinsic value per share of 41.4% (as discussed in more detail below). Most of Trupanion's intrinsic value is derived from our direct-to-consumer, monthly subscription business.

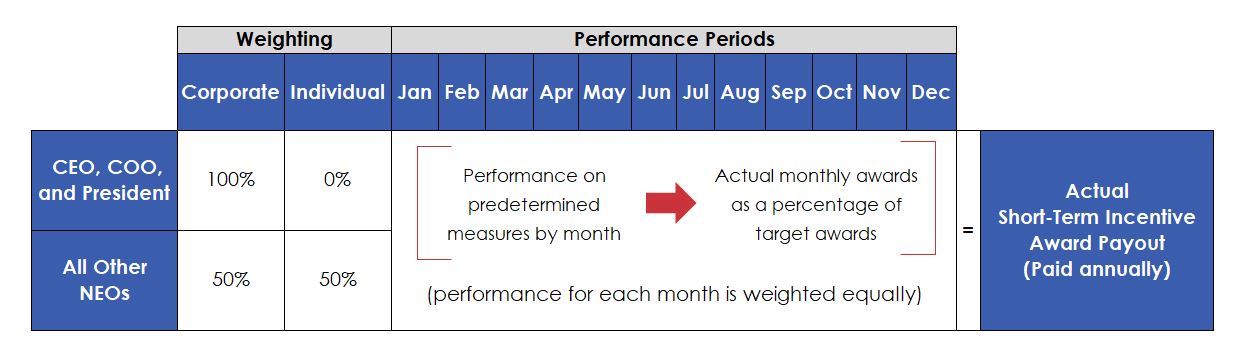

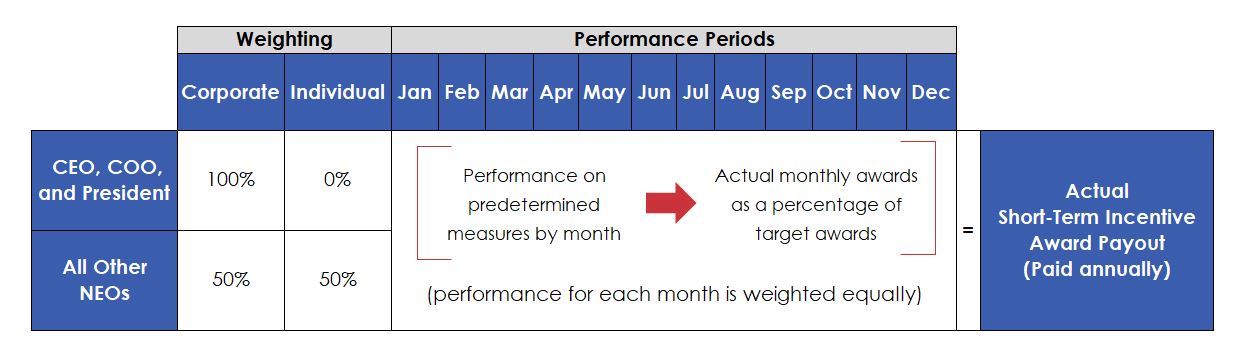

In prior years, we set corporate and individual goals on a quarterly basis. Beginning in 2021, we moved from quarterly goals to monthly goals in an effort to allow us to refocus our efforts quickly in response to changing business needs. The corporate objectives include the enrollment of young pets at an acquisition cost within our targeted internal rate of return, the deployment and utilization of our patented software as well as improved member experience and retention. These objectives drove our evaluation of the 2021 Company performance.

In 2021, for purposes of evaluating Company and team compensation, we estimate that intrinsic value per share grew by 41.4%. Key performance metrics from 2021 include:

•Gross New Subscription Pet Growth of 223,080 and an Average Monthly Retention rate of 98.74%, resulting in Net New Subscription Pets of 126,376 (or 51% year-over-year growth);

•Adjusted Operating Income of $78.5 million (or 37.4% year-over-year growth); and

•Anticipated Internal Rate of Return of new subscription pets of 36%

For further detail on the calculation of our key performance metrics, see the section of this CD&A titled “6.7 Discussion on Key Performance Metrics”.

2.3 Compensation Highlights

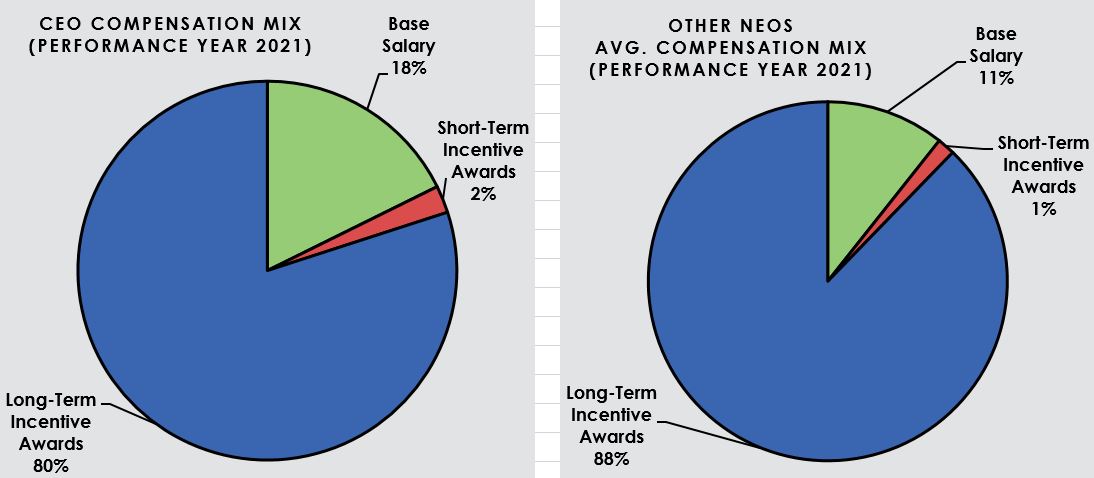

Compensation Philosophy

The primary objective of Trupanion’s compensation program is to align team member incentives with long-term stockholder interests. To accomplish this, we:

•Strive to compensate team members based on value contributed;

•Share increases in Company value among stockholders, leadership and employees in a sensible way;

•Link equity award grants to growth in our calculated intrinsic value per share;

•Link performance metrics and goals to the Company’s business strategy;

•Recognize team and individual contributions through pay-for-performance incentive awards;

•Encourage equity ownership by emphasizing equity in the overall executive compensation mix, facilitating equity ownership by all employees, and requiring equity ownership by executives and directors;

•Provide a pay package that will attract, reward, focus, and retain critical talent;

•Ensure that our incentive plans do not encourage undue risk-taking nor behavior that is contrary to the intent of our incentive plans by utilizing time-based vesting for equity awards; and

•Communicate openly with employees about how their compensation mix is structured, the rationale behind this structure, and the decisions around their individual pay.

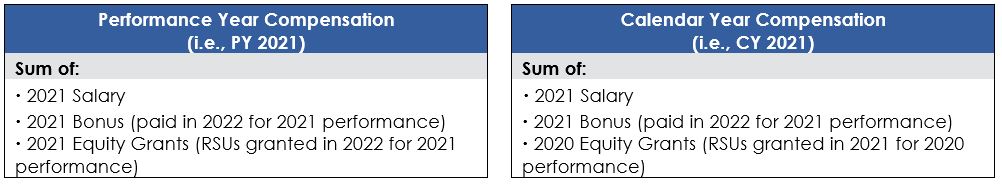

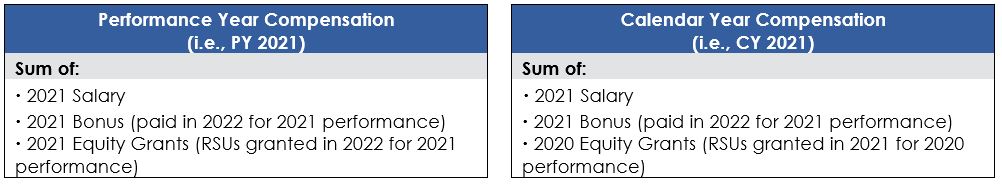

Consideration of "Say-on-Pay" Vote